The Australian Vanadium Project is one of the most advanced vanadium projects currently being developed in the world. It was awarded Federal Major Project Status by the Australian Government in September 2019 in recognition of its national strategic significance and State Lead Agency Status by the Western Australian Government in April 2020 due to its importance as a battery and critical metal project.

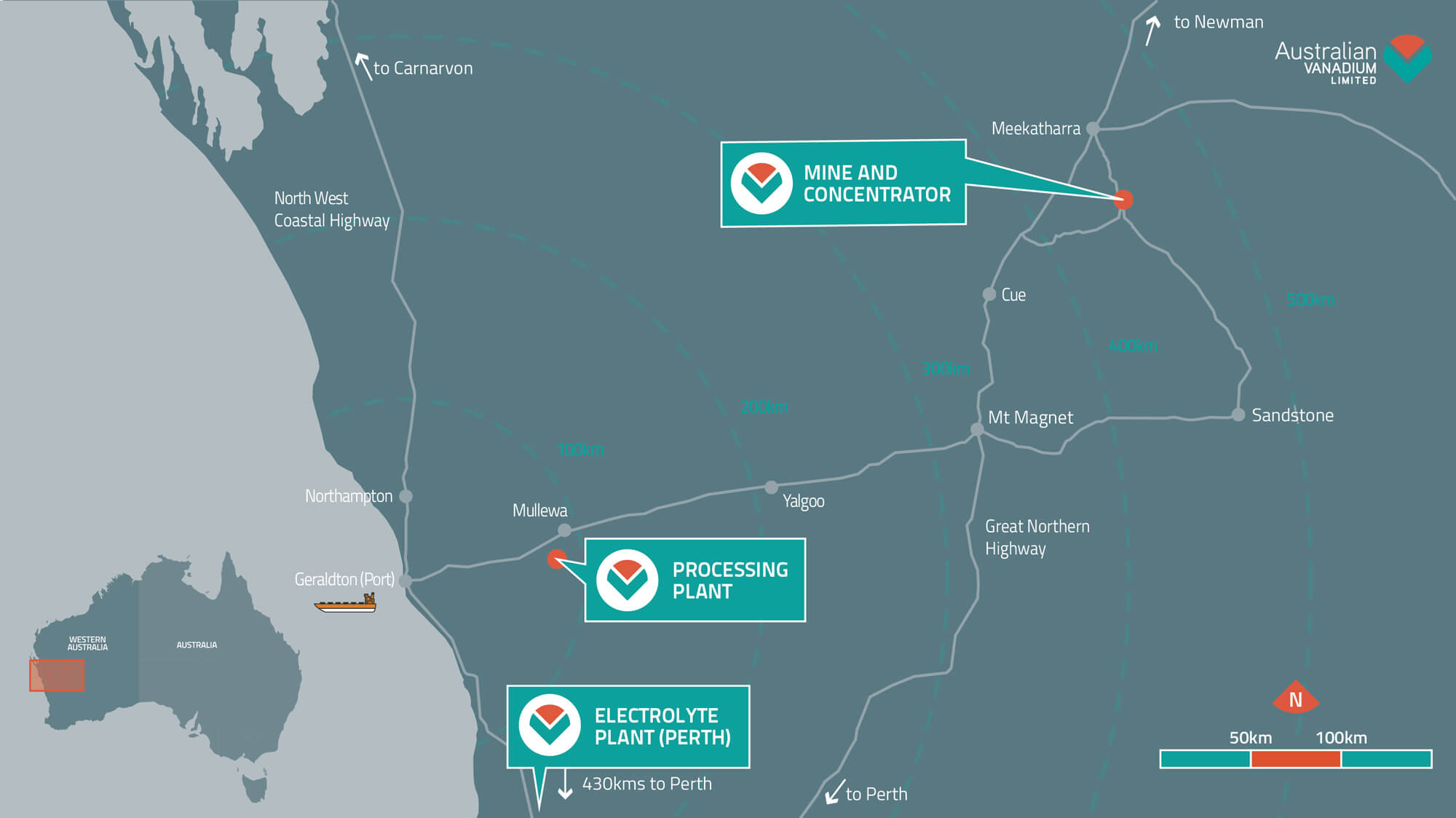

The Australian Vanadium Project consists of a high-grade V-Ti-Fe deposit located in the Murchison Province approximately 43kms south of the mining town of Meekatharra in Western Australia and 740km north-east of Perth and a processing plant located near the port city of Geraldton.

The Project consists of 15 tenements covering approximately 200 sq km and is held 100% by Australian Vanadium Limited (ASX: AVL).

Mining Lease Application M51/878 has been granted and covers about 87% of the Mineral Resource, with the balance of the Inferred Mineral Resource located on E51/843, fully owned by AVL.

AVL Released its Bankable Feasibility Study on 6th April 2022

The Mineral Resource for the Project was updated on 1st November 2021 (see ASX announcement Mineral Resource Update at The Australian Vanadium Project) and its Ore Reserve was updated in the BFS.

The total Mineral Resource is 239Mt at 0.73% vanadium pentoxide (V2O5) consisting of:

- Measured Mineral Resource of 11.3Mt at 1.14% V2O5,

- Indicated Mineral Resource of 82.4Mt at 0.70% V2O5, and

- Inferred Mineral Resource of 145.3Mt at 0.71% V2O5.

The Mineral Resource includes a distinct massive magnetite high-grade zone of 95.6Mt at 1.07% V2O5 consisting of:

- Measured Mineral Resource of 11.3Mt at 1.14% V2O5,

- Indicated Mineral Resource of 27.5Mt at 1.10% V2O5, and

- Inferred Mineral Resource of 56.8Mt at 1.04% V2O5.

The Mineral Resource includes an estimation of cobalt, nickel and copper:

- Initial Inferred Mineral Resource is 14.3 Mt at 208ppm Co, 666ppm Ni and 217ppm Cu and 0.16% Sulphur*

AVL’s Ore Reserve is based on the BFS results:

| Ore Reserve | Mt | V2O5% | Fe2O3% | TiO2% | SiO2% | LOI% | V2O5 produced kt | Ore Reserve | Mt |

| Proved | 10.5 | 1.11 | 61.6 | 12.8 | 9.5 | 3.7 | 70.9 | Waste | 238.5 |

| Probable | 20.4 | 1.07 | 63.4 | 12.2 | 9.2 | 3.0 | 152.9 | Total Material | 269.4 |

| Total Ore | 30.9 | 1.09 | 62.8 | 12.4 | 9.3 | 3.2 | 223.8 | Strip Ratio | 7.7 |

Bankable Feasibility Study (BFS)

The results of the BFS (see ASX announcement Bankable Feasibility Study for the Australian Vanadium Project) indicate a Project with a well defined resource base, robust economics and utilising an industry standard, low-risk method of beneficiation and refining to produce a vanadium pentoxide (V2O5) flake product. Capital and operating cost estimates have been developed to the level of accuracy of ±15% and include mine and processing circuit designs, a detailed financial model and supporting bodies of work. Technical studies, including a period of three years of extensive piloting testwork, have supported robust processing flowsheets, de-risking the Project towards funding and delivery.

The Project is based on a proposed open pit mine; crushing, milling and beneficiation plant (CMB) and processing plant for final conversion and sale of high quality vanadium pentoxide (V2O5) for use in steel, specialty alloys and energy storage markets. The BFS results confirm AVL’s potential to become a new, low-cost primary vanadium producer.

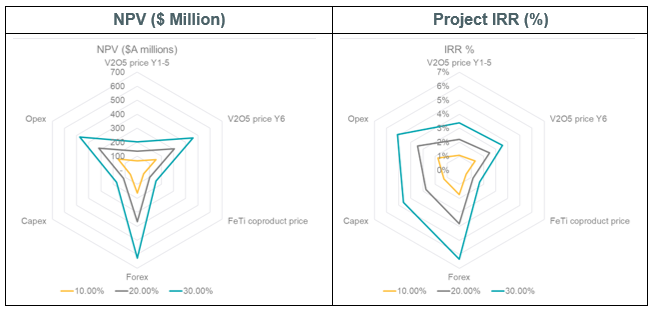

In the table below, NPV7.5% and IRR are reported at various V2O5 pricing assumptions.

NPV and IRR are reported at various V2O5 pricing assumptions. Assuming a V2O5 price of US$10.50/lb, pre-tax NPV is A$833M, with an IRR of 20.6%. Using US$9.50/lb V2O5, the pre-tax NPV of A$531M highlights that the Project is robust and offers attractive returns even at conservative pricing assumptions.

Key Financial Outcomes

| Pricing Year 1-5 Pricing Year 6-17 | US$9.50/lb V2O5 US$9.50/lb V2O5 | US$10.50/lb V2O5 US$9.50/lb V2O5 | US$10.50/lb V2O5 US$10.50/lb V2O5 | US$12/lb V2O5 US$12/lb V2O5 |

|---|---|---|---|---|

| pre-tax NPV 7.5% | A$531M | A$623M | A$833M | A$1,287M |

| post-tax NPV 7.5% | A$295M | A$361M | A$507M | A$823M |

| IRR | 16.1% | 18.4% | 20.6% | 26.9% |

| Payback period | 8.6 years | 7.8 years | 7.3 years | 6.2 years |

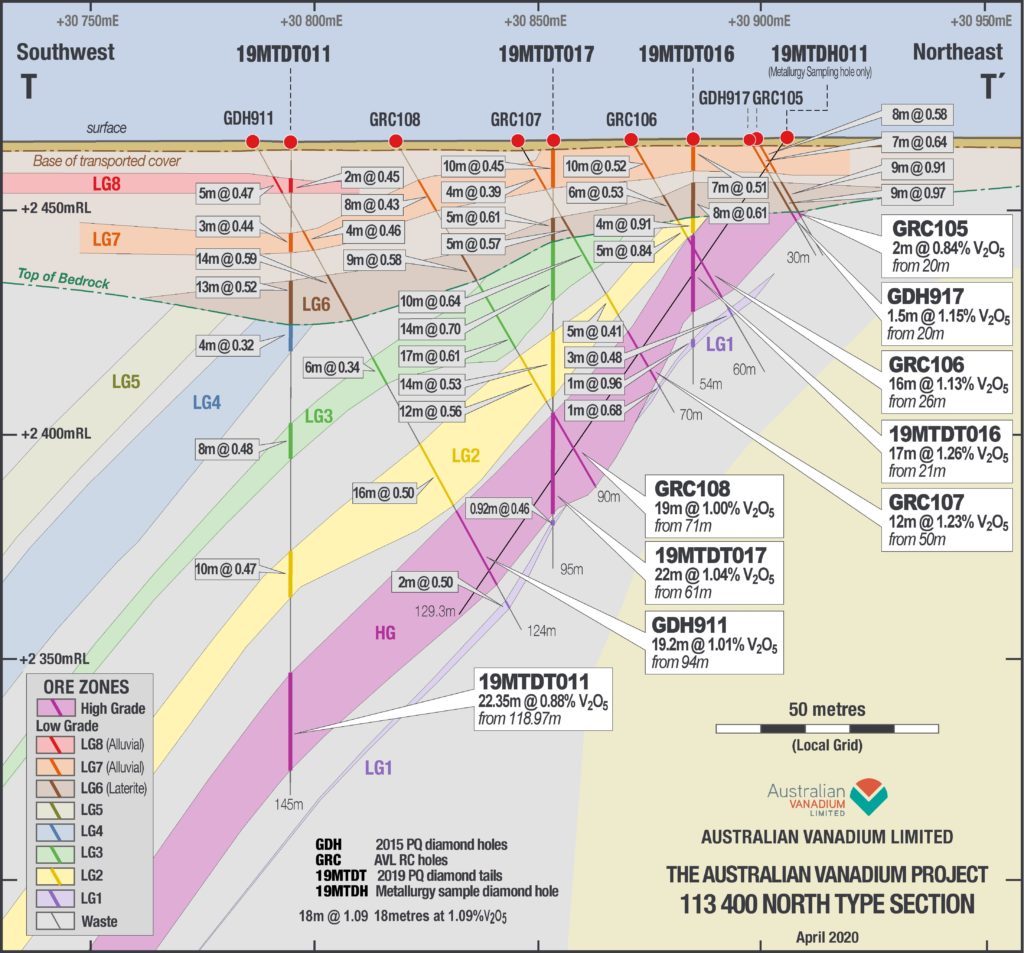

The mineral deposit consists of a basal massive magnetite zone (10m – 15m in drilled thickness), containing greater than 0.8% V2O5, overlain by up to five lower grade mineralised magnetite banded gabbro units between 5 and 30m thick, separated by thin waste zones (<0.3% V2O5).

Vanadium mineralisation is found in the basal massive magnetite horizon, as well as the lower grade banded magnetite gabbro horizons overlying the main high grade unit. (See typical cross section left).

The sequence is overlain in places by a lateritic domain, a transported domain (occasionally mineralised) and a thin barren surface cover domain. The deposit is affected by a number of regional scale faults which break the deposit into a series of kilometre scale blocks. The larger blocks show relatively little sign of internal deformation, with strong consistency in the layering being visible in drilling and over long distances between drillholes.

The Australian Vanadium Project – Mineral Resource Estimate

| Zone | Classification | Mt | V2O5 | Fe % | Tio2 | Sio2 | Al2O3 | LOI % |

|---|---|---|---|---|---|---|---|---|

| HG 10 | Measured | 11.3 | 1.14 | 43.8 | 13.0 | 9.2 | 7.5 | 3.7 |

| Indicated | 27.5 | 1.10 | 45.4 | 12.5 | 8.5 | 6.5 | 2.9 | |

| Inferred | 56.8 | 1.04 | 44.6 | 11.9 | 9.4 | 6.9 | 3.3 | |

| Sub-total | 95.6 | 1.07 | 44.7 | 12.2 | 9.1 | 6.8 | 3.2 | |

| LG 2-5 | Measured | - | - | - | - | - | - | - |

| Indicated | 54.9 | 0.50 | 24.9 | 6.8 | 27.6 | 17.1 | 7.9 | |

| Inferred | 73.6 | 0.48 | 25.0 | 6.4 | 28.7 | 15.4 | 6.6 | |

| Sub-total | 128.5 | 0.49 | 24.9 | 6.6 | 28.2 | 16.1 | 7.2 | |

| Transported 6-8 | Measured | - | - | - | - | - | - | - |

| Indicated | - | - | - | - | - | - | - | |

| Inferred | 14.9 | 0.66 | 29.0 | 7.8 | 24.5 | 15.1 | 7.8 | |

| Sub-total | 14.9 | 0.66 | 29.0 | 7.8 | 24.5 | 15.1 | 7.8 | |

| Total | Measured | 11.3 | 1.14 | 43.8 | 13.0 | 9.2 | 7.5 | 3.7 |

| Indicated | 82.4 | 0.70 | 31.7 | 8.7 | 21.2 | 13.5 | 6.2 | |

| Inferred | 145.3 | 0.71 | 33.0 | 8.7 | 20.7 | 12.0 | 5.4 | |

| Sub-total | 239.0 | 0.73 | 33.1 | 8.9 | 20.4 | 12.3 | 5.6 |

The Australian Vanadium Project – Mineral Resource estimate by domain and resource classification using a nominal 0.4% V2O5 wireframed cut-off for low grade and nominal 0.7% V2O5 wireframed cut-off for high grade (total numbers may not add up due to rounding).