Highlights:

- Maiden Ore Reserve of 18.24Mt at 1.04% V2O5 comprised of a Proved Reserve of 9.82Mt at 1.07% V2O5 and a Probable Reserve of 8.42Mt at 1.01% V2O5

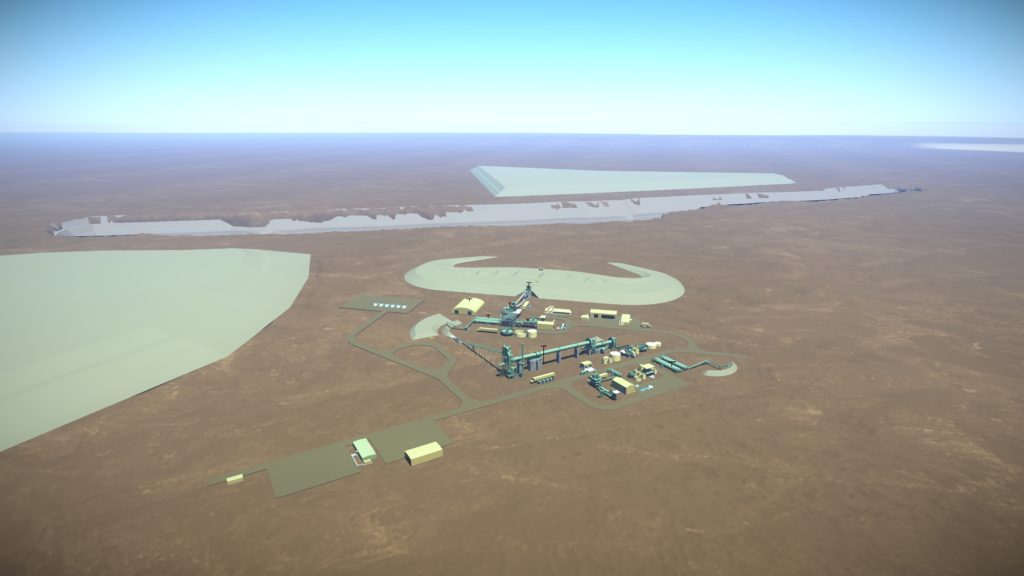

- Open pit mining and beneficiation operation producing approximately 900,000 tonnes per annum of 1.40% V2O5 magnetite concentrate at an average yield of 60%

- Planned vanadium pentoxide (V2O5) refinery at the Australian Vanadium Project site with a production rate of approximately 22.5Mlb V2O5 per annum over an initial mine life of 17 years

- Significant potential to extend operations and mine life along strike for an additional 8km within Mining Lease Application M 51/878

- Average C1** operating expenses estimated at US$4.15/lb V2O5 equivalent (±25%), competitive with the world’s lowest quartile producers

- Capital costs of approximately US$354 million (±25%). This includes owner’s costs, contingencies and a partial gas pipeline investment.

- Ungeared post-tax NPV8% ranges between US$125 million and US$1.41 billion, depending on the pricing assumption, indicating a robust project

- Conservative long-term average V2O5 product pricing assumption of US$8.67/lb used for financial modeling. Medium term price assumptions of US$13/lb and US$20/lb are considered and presented

- Current V2O5 price trading at US$22/lb (source: Fastmarkets) with anticipated ongoing supply shortfall until at least 2025

- Positive outcomes and strong vanadium market fundamentals support immediate progression to a Definitive Feasibility Study, with further drilling for pilot study scheduled to commence January 2019

- The mine plan includes 21% Inferred Resources. There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the production target itself will be realised

Gabanintha Pre-Feasibility Study and Maiden Ore Reserve

View PDF (3 MB)