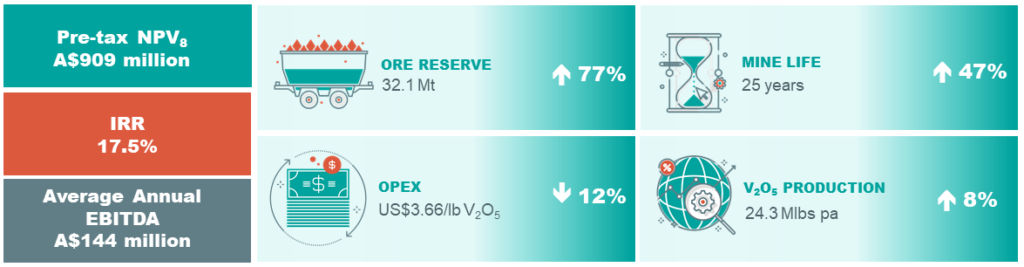

- Project pre-tax NPV8 of A$909M increased from A$320M (up 184%).

- Project IRR rises to 17.5% (up 41%).

- Project payback of 6.6 years (down 17.5%).

- C1 operating cost of US$3.66/lb V2O5 competitive with world primary vanadium producers, includes iron titanium (FeTi) coproduct credit (down US$0.49/ lb V2O5).

- Project annual EBITDA average for 25 years of A$144M (up 31%).

- Plant and associated infrastructure capital cost of US$253M.

- Total Project capital cost of US$399M (up 13%) includes area and regional infrastructure, indirects, EPCM, growth and owner’s costs.

- Ore Reserve increased to 32.1Mt at 1.05% V2O5 (up 76%) comprised of a Proved Reserve of 9.8Mt at 1.08% V2O5 and a Probable Reserve of 22.4Mt at 1.04% V2O5 (rounding is applied).

- Increased anticipated mine life from 17 to 25 years, supporting a long-life, consistent ore feed operation on AVL’s granted mining lease.

- Increased nominal vanadium production to 24.3 Mlbs V2O5 annually (up 8%).

- Forecast vanadium ore recovery to concentrate of 74.8% life of mine, supported by pilot testing.

- New innovative flowsheet for processing plant recovers 88% V2O5 utilising tried-and-tested grate kiln technology.

- Separation of processing plant from minesite provides access to cheaper competitive natural gas near Geraldton, local workforce and FeTi coproduct sales opportunities for 900,000 dry tonnes per annum over the mine life.

- Positive economic results give grounds for completion of Bankable Feasibility Study (BFS) mid-2021, finalising offtake, obtaining final approvals and securing project finance.

Technical and Financial PFS Update

View PDF (5 MB)